News in late last night took us by surprise – Siemens is intent on acquiring CD-Adapco for just a shade under $1 billion.

According to the press release, “Siemens and CD-adapco have entered into a stock purchase agreement for the acquisition of CD-adapco by Siemens. The purchase price is $970 million.”

$1 billion, give or take a few million. That’s quite a sum, particularly when you consider that CD-adapco’s revenue is around the $200 million mark – with some pretty healthy growth, it’s still a fair few old quid.

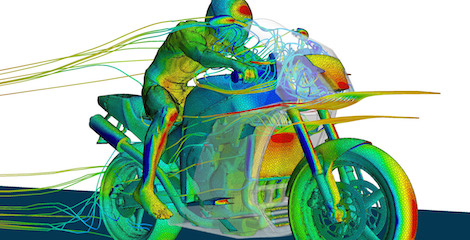

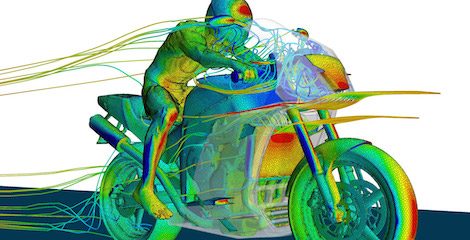

CD-adapco is one of a very small number of vendors supplying specialised and highly respected codes in a number of industries, with its reputation built on its mastery of computational fluid dynamics (CFD).

If you’d have looked back 10 years ago, CFD leaders were CD-adapco (with its Star-CCM products), Fluent and CFX. Fluent and CFX got snapped up in pretty short order by Ansys, leaving just CD-adapco on the market.

Some changes at the top, following the passing of its founder and CEO last year, meant that the privately owned company was on the market – and Siemens stumped up the cash.

Why so much? CD-adapco’s code is high-end, used heavily in the automotive, marine and aeropspace industries, exactly where Siemens PLM operates.

Put alongside its other acquisitions in the last few years, such as LMS, this makes a lot of sense.

Klaus Helmrich, member of the Managing Board of Siemens, commented that “As part of its Vision 2020, Siemens is acquiring CD-adapco and sharpening its focus on growth in digital business and expanding its portfolio in the area of industry software.

“Simulation software is key to enabling customers to bring better products to the market faster and at less cost.

“With CD-adapco, we’re acquiring an established technology leader that will allow us to supplement our world-class industry software portfolio and deliver on our strategy to further expand our digital enterprise portfolio.”

The CFD market is one that’s seeing a lot of action at the entry level – we’ve seen a number of start-ups come online in the last few months. But as ever, the real money to be made in CFD is at the high-end, the ultra complex and the ultra difficult problems that are the preserve of the automotive, the aerospace, the marine and the energy sectors.

This gives Siemens a foot into that camp, along with its enterprise class products like NX, Teamcenter and all that it acquired with LMS and its Nastran fork, NX Nastran.

Autodesk has some skin in the game after acquiring Blue Ridge Numerics. Dassault hasn’t made an acquisition in the CFD space, rather instead, developing its own Abaqus CFD code.

D3D’s friend, Monica Schnitiger, also has an interesting take that’s worth a read.

Particularly of interest are details of Dassault’s CEO, Bernard Charlès, emailing his extended team with reasons why they didn’t acquire CD-adapco themselves and revelling in their own CFD developments.

CD-adapco has long partnered with DS, particularly in the automotive/auto-sport/aerospace industries. Are DS going to try and move their customers onto their own platform, when there’s so much knowledge entrenched in the use of CD-adapco’s tools at many of these customers? Doubtful, at best.