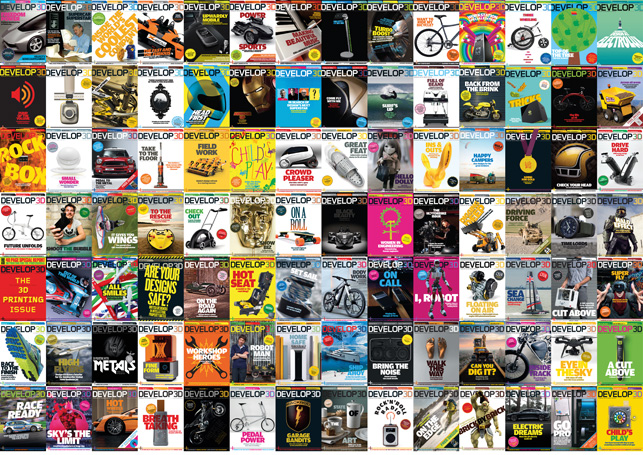

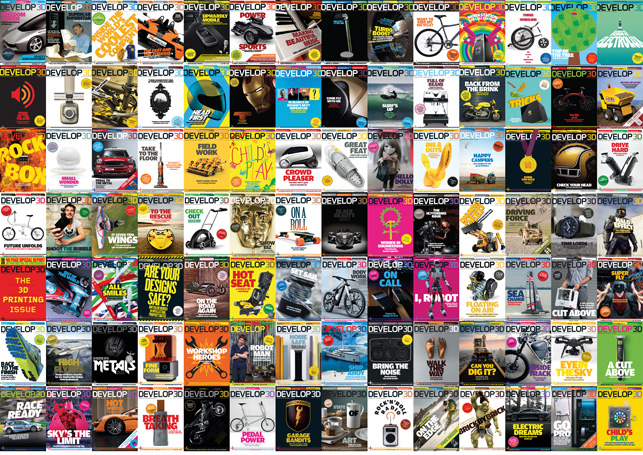

If you do anything once a month for 10 years, you tend to get good at it. And I like to think our little team has got pretty damned good at writing and publishing DEVELOP3D in the decade since we launched it back in June 2008.

In the Editor’s Letter in that first issue, we told our nascent readership that our goal was to provide “an insight into what the complex individual technologies do and how they can enhance your productivity, both from an end-user point of view, but also from a higher level business perspective.”

I like to think we’ve achieved that goal and then some. Looking back over the last 10 years, some things thave changed dramatically. If I look through the first year’s worth of issues (and they’re all available for download), almost a third of the vendors we covered have since disappeared, mostly through being acquired by larger vendors.

Some of the biggest names in the design and engineering technology game are gone. Their products have been rolled into other companies’ portfolios and their brand identities have dropped off the face of the planet. But, at the same time, a whole host of start-ups have emerged over the same period.

What’s interesting is that the same same four big vendors control the market: Siemens, Dassault Systèmes, PTC and Autodesk. What’s even more interesting is that, largely speaking, their collective product ranges haven’t changed that much either.

They still have the same names, for example. A few have sprung offshoots and given rise to new variants, and yes, the capability in those systems has evolved with time, but a general Powerpoint presentation would have pretty much the same story to tell, the price would be roughly the same, and users would probably use the tools in much the same way as they did in 2008.

Today, SolidWorks has an estimated half a million or more commercial customers using a system that they have knowledge and investment in. Any startup looking to disrupt that is going to have to come at it with more than a promise of cheaper costs and cheaper hardware

So where’s the hot new action? The answer is that we’re now at the stage of the game where it’s very hard for a startup to gain traction. Consider when SolidWorks launched in 1998 with a low-cost alternative to Pro/Engineer on cheaper hardware.

At the time, Pro/E had a user community measuring in the tens of thousands, so it wasn’t hard to offer a cheaper alternative and gain traction quickly.

Today, SolidWorks has an estimated half a million or more commercial customers, using a system that they have knowledge and investment in. Any start-up looking to disrupt that is going to have to come at it with more than a promise of lower costs and cheaper hardware.

Perhaps this is where things are going to shift. At present, there really is a revolution happening in additive manufacturing. This could be the forerunner to a true shift in how we manufacture products – more tailored, more automated, more flexible in their form and function. To truly take advantage of this, we’re going to need a dramatically different set of tools to design for these processes.

Right now, I’m not 100% convinced that the key players are ready. So perhaps this is where smaller, more nimble start-ups can thrive and grab some market share – but as we know, a promising startup is more likely to get swooped on by a major player before it takes flight. Even so, part of me hopes to see fresh competition emerge and inject some new excitement into the market.

Elsewhere, PTC just took a billion bucks from Rockwell; however you cut it, that’s got to have an impact on its CAD tools. Siemens is forging ahead with its Industry 4.0 ambitions.

Autodesk seems, I don’t know, a little lost at present and in a period of consolidation.

Dassault? Well, that’s anyone’s guess. It seems to me that this could be a very good time for some canny entrepreneur to sneak in the back door while nobody’s looking.