The architecture, engineering and construction (AEC) industry is undergoing a revolution. We live in an era in which we will likely see its complete digital transformation, from concept to fabrication.

While many in the AEC industry may think the adoption of building information modelling (BIM) is an end in itself, moving from 2D to 3D was actually just the initial phase in a longer process of digitisation that will take us into computationally assisted design, automated manufacture and assembly.

While this may sound far-fetched to those working in the construction industry today, others from the manufacturing sector have seen it all before. In that sense, AEC’s direction of travel and final destination is a case of history repeating itself.

There are firms now racing to get the benefits of digital prefabrication, the modular mass production of buildings intended for mainstream markets – houses, offices, hotels. This will be delivered through the convergence of many technologies and processes appropriated from the rather more mature market of industrial-scale manufacturing, particularly aerospace and automotive.

To add fuel to the fire, there has been a huge level of interest and investment from venture capital firms hoping to back the ‘Tesla’ of buildings and later reap the returns.

This has led to a massive increase in the creation and development of ‘building factories’, with new start-ups and mature players spending billions to be the first to dominate the market.

In preparation for this article, I found all sorts of new, wannabe building design and digital fabricators: FactoryOS, Katerra, D*Haus, Boklok, Go Modular, Connect-home, Popup House, Cube Haus, Fabcab, Kiss House, Plant Prefab, Blokable, Module, Kasita, Fullstack Modular, to name but a few.

Then there are the players already deeply invested in housing or functional buildings, like Marriott, and in the case of the UK, Berkeley Group, Legal and General and Ilke Homes.

There will be at least six more factories for producing prefab buildings in the UK within the next three years.

Additionally, many architecture firms have experimented with producing their own in-house modular teams/brands and tried some form of off-site construction, with varying degrees of success and failure. Many are working with prefab makers in China.

There have always been innovators in the AEC space; few know that Thomas Edison (he of lightbulb and phonograph fame) was absolutely fascinated with concrete. He realised it could be used to make cheap housing and set up a firm around a 1908 patent for cast-in-place concrete houses made from single-poured facades in reusable formwork.

Edison didn’t stop there, either; he investigated concrete roofs, partitions, bath tubs, floors, picture frames and even a piano. He lost millions in the process, but it’s not a million miles away from fans wanting to see the 3D printing of buildings onsite.

In the context of this article, however, I believe that 3D printing will be an atypical way of mass constructing complete buildings for quite some time yet.

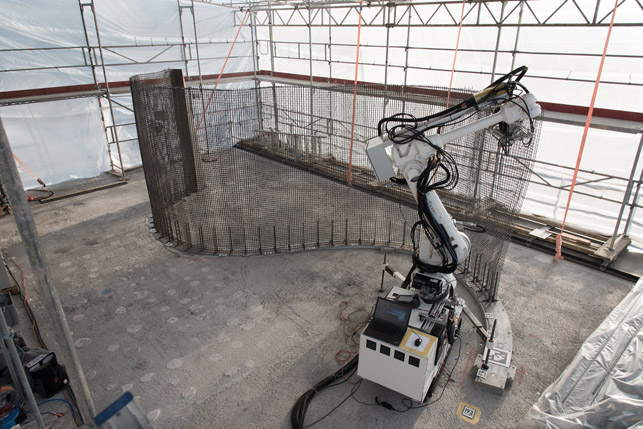

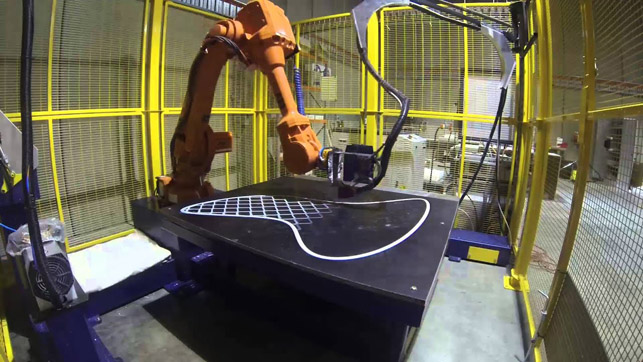

That said, I will admit that there are cases where 3D printing has been used to great effect, such as by Laing O’Rourke on the concrete panels at the new Crossrail stations. Laing used a 6-axis gantry robot with a 3D printing attachment to make 1,400 moulds for the 36,000 concrete panels.

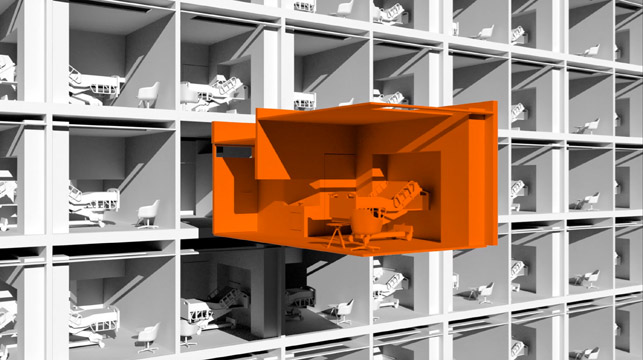

Hospital, designed by Nordic Office of Architecture, includes a high level of repetition

Digital fabrication

Signature architects, those pushing the boundaries of form and materials, have frequently had to look outside of the AEC industry to fabricate components, with amazing results.

I’m thinking of Herzog & de Meuron/Arup Sports’ Bird’s Nest Stadium for the Chinese Olympics, or many designs by Foster + Partners, Zaha Hadid Architects and others, who turned to shipbuilders and their CAD systems and processes to fabricate large-scale components for buildings.

Frank Gehry, who famously said he couldn’t find the power switch on a computer, let alone use one, has a team of experts who take his paper models and use Dassault Systèmes’ Catia to define the structure and digitise the metal cutting, so that his practice can make a warped wall for the same price as a straight one.

What’s important here is that Gehry chose to be outside of typical providers of architectural design tools, opting for a system more commonly used in aerospace, automotive and shipbuilding, because the key benefit was in the digital fabrication element.

Prior to using this system to precisely model structures, Gehry’s buildings were seen as too risky and costly to make, due to their complexity, which generated wildly inflated quotes from fabricators.

When 2D drawings were dropped in favour of explicit Catia models, Gehry’s fabrication quotes all came within 1% of each other.

In the mass market, there has obviously been a longstanding prefab building market and many, many attempts at modular modernist designs, but these have always been niche.

Very few of these have benefited from true digital fabrication, as they are more often assembled within a factory by builders and then shipped onsite. This offers the benefit of rapid assembly onsite, but the inefficiencies of manual labour remain.

However, connecting building design to digital fabrication has the potential to change the game, with automated cutting and configuration systems to enable customers’ design choices to be fed directly into the production system.

The biggest steps forward in this methodology have been seen in countries where timber frame structures are popular, such as the US, Australia, Scandinavia, Switzerland and mainland Europe.

These buildings range from tiny ‘garden offices’ to the famous German Huf-Haus and Katerra’s ‘off-the-shelf’ eight-floor office blocks. The current tallest cross-laminated timber (CLT) building, incidentally, is the 18 storeys high, 85.4 metre Mjøstårnet in Norway, by Voll Arkitekter.

This concept is now taking off, even in countries without a strong history of prefabrication.

In the UK, Legal and General and Berkeley Homes are building huge factories, requiring significant investment, for the assembly of mass housing. They are just two of at least six UK housebuilders changing the way they will, in future, deliver residential new builds.

This has gone beyond the early experiment stage and is now a race for housebuilders to improve efficiency and adopt more automation.

It will be interesting to see if timber frame takes off in the UK, and if timber frame will be acceptable to a population that has tended to shun wooden houses.

Also, will these properties be mock Tudor, or brick-clad – or will people want something more modern? Developers such as Urban Splash, for example, have built a number of developments using modern prefab aesthetics.

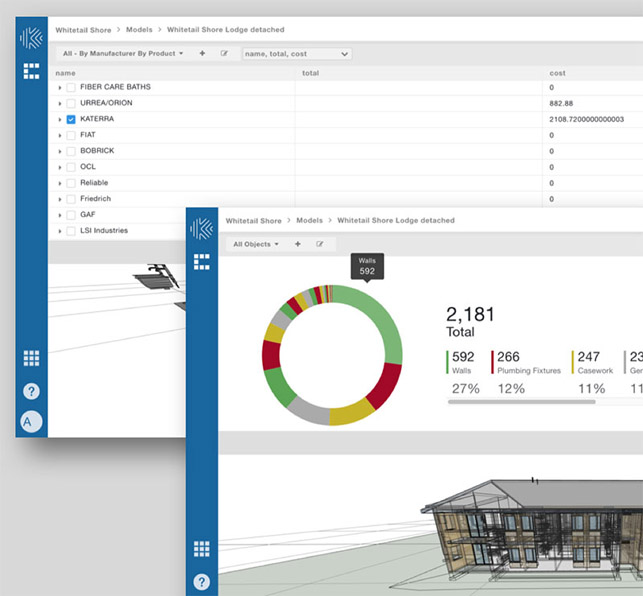

Katerra’s Apollo software suite covers the entire building lifecycle from inception and design to operation

The $4 billion ‘start-up’

When examining this movement towards digital fabrication, it’s perhaps best to look at one of the more extreme examples of a firm attempting to significantly change everything about the process, from the role of the developer, through the manufacture of the building, to its sale, rental and lifespan.

Katerra is a Silicon Valley design build firm, owned by Michael Marks, Jim Davidson and Fritz H Wolff. Marks was former CEO and chairman of Flextronics (the electronics design, fabrication, assembly and test company) and a former interim CEO at Tesla.

The company was only started in 2015, but has become a trailblazer following significant investment. It’s now worth an estimated $4 billion. In just four years, it has grown to over 5,000 employees and is working on $3.7 billion worth of projects in the US alone – but rumours suggest it may have ten times that much in its global bookings pipeline.

The mission of the company is to remove inefficiencies in the construction industry by defining its own processes to handle everything from the architectural design of a building to off-site construction and installation. To do this, it’s relying heavily on new technology and automation in its factories, as well as for site development, schematic design, fabrication of parts and onsite construction.

The scale of the company in terms of mass timber is really incredible, having its own cross-laminated timber factory and aiming to be one of the world’s leading suppliers. In fact, owning resources has become a key part of the company’s mix, having expanded from timber frame assembly, to CLT production, to steel frame and now having acquired a concrete firm too, with eyes on markets in the Middle East and elsewhere.

In many respects, Katerra is aiming to be a ‘Boeing of buildings’. It will offer a range of scalable and configurable residential and office designs, which can be bought and ordered off the peg, or as a range of pre-configured modular parts, like floor systems, which have multiple applications.

The company is refining its own end-to-end production system, which utilises manufacturing-level CNC precision, together with parts management, using IoT technology to track and deliver all the flat pack assemblies and components necessary onsite, requiring considerably less labour than before and enabling completion rates measured in days and weeks.

We attended the launch event of its new building platforms in Las Vegas in February and saw a number of residential and office designs created using manufacturing and assembly from the outset.

The firm has its own integrated team of architects and engineers to define wall and floor systems, casework, bathroom and kitchen kits, as well as multiple configurable elements, such as finishes.

Each design complies with 48 State building and energy codes, comes with a complete bill of materials and provides developers with swift feasibility, permitting and cost estimates.

But Katerra isn’t stopping at the building framework; it has completely developed its own energy-efficient windows, reinvented the heating and cooling system for each apartment and developed its own AI-enabled power cabinet for whole buildings. If the engineering team finds an element of a building that can be improved, it seems inclined to do it. Even the packaging for the bathroom, when shipped to site, forms part of the installation.

One of the interesting drawbacks to factory-assembled buildings is quite surprising. Katerra’s dry walls contain everything when shipped – electrical, plumbing, heating, controls – for fast assembly. Each US state has different rules on building inspection, but it’s usual that if a wall shipment crosses state lines, it has to be opened up during construction to be inspected to see it conforms to code. This is like buying a Ford motor car in London and driving to Scotland, only to be stopped to check its wiring conforms to UK specification. It’s clear that building regulations and inspection need to catch up with prefabricated components.

The rapid rise of Katerra from 2015 to today is just astounding – from zero to working on $3.7 billion in projects in around four years.

The reality, however, is that it’s still early days for the company; it has only just begun to properly define its processes and it’s clear that a lot of what’s available on the market to help it in its work, such as building components or off-the-shelf software, won’t be up to scratch, so the company will need to develop these in-house.

Katerra and CAD

The AEC market has suffered from tremendous inefficiencies. Building information modelling (BIM) was seen as an advance on old 2D systems, because 3D models could generate all the drawings legally required, with coordinated updates when edited.

The additional benefits it offers of renderings, potential analysis and providing a central repository for all relevant data has further excited the industry.

However, and there really are no two ways of saying this, all BIM systems currently on the market were never designed to drive a digital fabrication process, to generate the g-code that runs CNC machines.

They have predominantly been written to address current workflows, based around documentation. The phrase ‘digital twin’ is now being used in the context of BIM, but the reality is that BIM models do not contain enough information to be a real ‘twin’; they are just geometrical representations, lacking fabrication-level detail.

To drive fabrication machines, models would have to be created with a much higher level of 1:1 detail and accuracy, a level that would quickly kill their performance and make them unusable. Today’s BIM tools will not provide an end-to-end solution for any digital fabricator. Instead, these companies tend to use manufacturing-based tools like Solidworks or Tekla Structures.

From talking to the Katerra team, the company is re-evaluating its product development technology stack and in fact has hired a host of ex-Autodesk employees to join its software division.

In the same vein of developing or redeveloping building equipment, which it thought it could do better, Katerra has outlined plans to deliver what it calls Apollo, a cloud-based software-as-a-service (SaaS) offering.

This will provide an operating platform with its own applications delivering “persistent data, so teams can better execute timely decisions as well as increasingly automate tasks.”

This software provides a source of persistent data with zero loss from programme inception, across design, construction and the duration of the building’s life.

From what I can tell, the intention is to first develop an application, similar to Procore construction management software, for Katerra’s own internal use. Once the company has tested this system on its own processes, it will offer it to the wider development and building community.

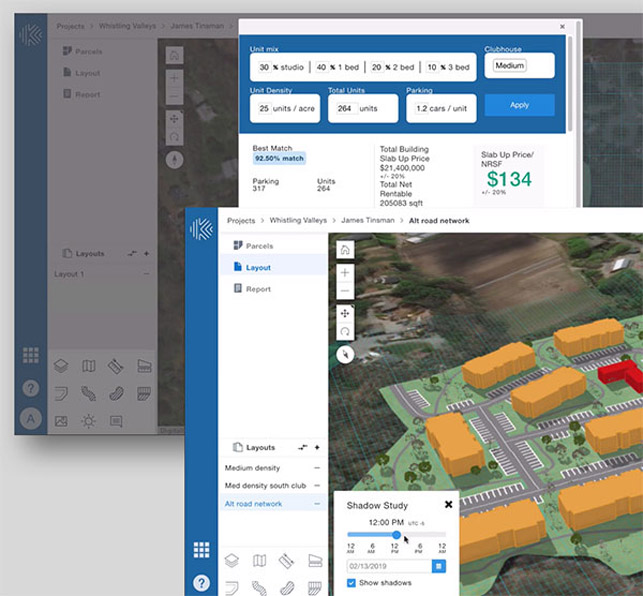

Soon after, several other components will be added to Apollo. These will include Apollo Insight, for rapid site evaluation, automated site planning, early cost and schedule forecast, and 3D design analysis tools; Apollo Connect, for material selection, design configurations and design review; and Apollo Construct, for construction management, budget and schedule tracking, centralised documentation.

Apollo also features an open API for further third-party integrations. By all accounts, the launch and feature set did not go down too well at Autodesk HQ.

Currently, the backbone of Katerra’s development work has been Autodesk Revit, with models having to be exported and then fed/remodelled through a range of other applications to get the g-code required to drive the cutting machines.

As the process has become more automated, the building types larger and the company more reliant on digital fabrication, the gap between traditional BIM capabilities and those required for manufacturing have made for interesting conversations with the design team.

The topic turned to CAD systems such as Dassault Systèmes’ Catia, the benefits of which had not been lost on them. In a conversation with the architectural team, the idea that you could model 1:1 with all fabrication details, not have the system slow down to a crawl and be able to natively produce g-code to drive manufacturing, together with other downstream processes such as analysis, enterprise resource planning (ERP) and product lifecycle management (PLM) was judged to be extremely attractive – even if it meant having less architectural-flavoured tools at the design end, or possibly using one to drive the other.

Revit’s ‘family of parts’ methodology isn’t that far away from the way modular works. It would be possible to have a definition of an architectural model that linked to a pre-defined assembly in Catia. In fact, London-based Facit Homes has already developed a system from which g-code can be derived from the Revit model, for cutting onsite in a shipping container, although not at this scale.

Bruce Bell’s view of factories to make buildings offers a very different perspective. He spoke last year at NXT BLD.

Over the past year, there has been a growing interest and excitement inside Dassault Systèmes about what digital fabrication could mean, in terms of the potential its solutions have in the AEC market. Dassault executives tell us the company is working with six or more large modular fabricators to optimise design to fabrication processes, learning from automotive and aerospace.

The one key takeaway for me is that, in today’s AEC world, all the concern is on digital document or model management; it’s still all about PDFs and collaboration. In a digital fabrication/modular world, it’s all about components, assemblies and process – and this is throughout the fabrication and lifecycle of the building.

PLM, championed in the world of manufacturing, most certainly becomes a new key repository for factory-made buildings, and connections to other fabrication systems like ERP for fabrication are essential – and more essential than BIM.

Digital fabrication – design for manufacture

Another impactful role, in the drive for automation, resides with the initial designers.

If architects have no concept of what is possible in the production process, then they can introduce inefficiencies or devise assemblies that increase the cost or reduce the quality of the finished building. In the engineering world, it is still possible to find design engineers who create product assemblies that the production engineers have to amend, in order to enable the manufacture of components.

There will be very few architects who fully understand the digital fabrication limitations of building fabrication systems. Design for manufacture and assembly (DFMa) is a separate discipline in itself and requires a holistic view of what is possible and what’s available, as well as the cost implications of early design decisions around processes, material use and serviceability.

With growing use of computational tools and algorithms, it is becoming increasingly possible to produce complex geometry, which may benefit from new digital manufacturing processes, such as 3D printing or Knitcrete. The software could also be deployed to check designs for manufacturability, based on rules, or take a form and approximate it with the tools used by a digital manufacturer.

In the manufacturing world, this is already possible; Autodesk has developed a system that can look at a part and optimise the geometry for the intended production process.

Sand casting (cheap) would look dramatically different to metal 3D printing (expensive), but both would meet the functional criteria. I envisage a future where you might simply state the material for a building structure and the geometry would change, based on whether it was timber or steel.

Digital fabrication – flexible workflow

The reality is that there won’t be one correct way to implement digital fabrication in the building industry, because everyone currently involved is having to work it out for themselves.

We will see single-platform, end-to-end players like Katerra develop and refine everything they need for themselves. Then there will be firms that choose not to be software developers, instead relying on existing systems, a more componentised approach to design and assembly and a network of trusted suppliers for components.

We’ve already seen design teams create modular designs and then go off to find a fabricator to work with, knowing their skill is in ideation, not fabrication. We will see factories of robots producing buildings, factories with humans producing buildings, and mixtures thereof – but the trend has to be towards full automation at some point, as it is in nearly every manufacturing sector.

Not all factories will survive. As with all trends, we are seeing a glut of investment, as people are betting big on backing the winners in a multi-trillion dollar industry. The benefit of today’s federated approach to designing construction is its flexibility and ability to adapt to the ebbs and flows of building cycles, booms and busts.

When you have an asset like a factory, it really needs constant throughput to make economic sense. One only has to visit disused shipyards around Britain to see what happens when orders dry up.

Therefore, factories for buildings need to be as flexible as possible, in order to shift from creating low-cost residential buildings, to offices, to hospitals, to schools, to universities, to McMansions, as demand dictates. Today’s digital tools, programmable robots and flexible design systems, meanwhile, should enable well-planned factories to dynamically change to meet different economic winds.

ETH Zurich’s DFAB house, with steel reinforcement placed by robots

CAD competition

Looking at the current focus within the CAD world, there are two standout companies that see the potential of the digital fabrication market: Autodesk and Dassault Systèmes (DS). Trimble does have strong capabilities in digital fabrication through the highly competent Tekla Structures but, with SketchUp, doesn’t have the same depth of functionality for front-end design.

Other traditional CAD/BIM software developers are not vocal within the space. Bentley Systems MicroStation and Nemetschek Vectorworks both use the Parasolid solid modelling engine, which is inside Siemens PLM NX, a CAD tool used by many automotive and aerospace companies, so the potential is there.

Nemetschek is also progressing with McNeel Rhino for computational design. BricsCAD has the ACIS solid modeller and has a manufacturing feature set in the same tool, so also has some potential.

There is also always the chance that Siemens PLM could enter the fray as DS’s main competitor in manufacturing and PLM. It already owns 9% of Bentley Systems and has some co-developed AEC tools, based around factories. PTC, another big player in the manufacturing space, has had aspirations in AEC before, but is showing no signs of rekindling its interest. (The company acquired Reflex from Dr Jonathan Ingram, which it then spun off with the developers who created Revit, which, in turn was bought by Autodesk.)

For now, we see Autodesk and DS jostling for position. Autodesk has Revit for traditional AEC workflows, Dynamo and Maya for computational generation, Inventor and Fusion for manufacturing and has stated its vision to develop for digital fabrication in the building space.

Dassault Systèmes owns Solidworks, which is already popular in architectural component manufacturing, and Catia, which is already used by Zaha Hadid Architects and Gehry, and is certainly developing something with Vinci Construction, which for now remains top secret. It also has a range of limited AEC tools.

The interesting thing here is that the strengths of these two main competitors are diametrically opposed. Autodesk is strong in AEC development to document, weak on large-scale digital fabrication.

DS is strong in large-scale fabrication, engineering management, but weak in architectural design tools. Will the market opt for the manufacturing bias or the architectural design biased tools? Neither technology stack is quite perfect. This could be an epic battle between Titans.

Autodesk makes its play

We talked with Robert Bray, senior director of pre-construction at Autodesk, who is responsible for Autodesk BIM360 Design and all offerings around pre-construction, including Assemble Systems, which Autodesk acquired last year.

In January, Bray took ownership of a project that had been running for 18 months inside Autodesk, around the convergence of construction and manufacturing. This project, the name of which has not been divulged by Autodesk, is not a commercial product yet.

But, according to Bray, “We are certainly headed that way and there is very much a need for an end-to-end solution, because people today are solving it with bits and pieces. But the problem is, the data doesn’t flow between them very well at all, so there is a lot of manual reflows and remodelling.

He continues: “I’ve been to see customers that are prefabricating at a very large scale. They are modelling in Revit, which they are very good at, but then they are handcrafting shop drawings and bills of materials, because they just can’t get that level of detail out of Revit.”

The problem he sees, from an industry perspective, is that if you’re going to build something in a modular or componentised way, you pretty much have to design with that intent in mind, from the start.

“One of the things that we’ve been struggling with, and I’m just going to be brutally honest with you, is how you reverse-engineer a standard architect’s model, now how do you reverse-engineer modularity? You literally can’t,” he says. “You have a very ‘dirty’ BIM and trying to reverse-engineer modularity on that. It’s an incredibly difficult problem.”

Bray explains that his team is building a platform on top of Jim Awe’s Project Plasma. Autodesk has a proof of concept that’s about 18 months into development, with considerable research and prototyping.

The concept is that there is a design model – this could be BIM, or even a bunch of PDFs – that the customer imports into the platform. Then, the software automatically creates what Autodesk calls ‘system structures’. These are layout frames, a simple abstraction of all the geometry, decomposing the BIM into its elemental systems. From there, the system ingests the design criteria for the elements to be fabricated – this data will never come from the BIM model. Instead, it will be the specification, the manufacturing notes.

“The second part of what we are doing,” he adds, “is taking the parts content and using Inventor at the moment. We are using that to prototype, but we realise in the future, we need to be open. We recognise the amount of Solidworks out there. Then there’s some logic as to how those parts fit together using a rules-based engine, based on logic and the captured design criteria. We could then automate the generation of a curtain wall system that knows the constraints, or in fact, that could be any panelised system.

From all this, we generate a fabrication solution, which will produce the BOM and the shop drawings.”

I point out that this won’t stop any architect designing something that can’t be made or perhaps doesn’t exist. Bray replies, “That’s why firms that are doing this are vertically integrated, because at the end of the day, the only way this really works is if the designers are actually designing based on these parts catalogues that are robust, rich and have the fabrication of logic.

So, my thinking is our initial target with all of this will likely be those already vertically integrated. That’s an easy target for us. Start with early proof of concept. We can work backwards towards broader industry after.”

I also raise the point of PLM being needed in the digital fabrication realm of AEC to manage the complex process. Bray responds, “We need the part catalogue content, and it really needs to be managed inside of a PLM system, whether that’s Fusion

Lifecycle, or some other future product, I don’t know yet. But there has to be a way for this content to be shared and consumed with Revit. This is where Plasma workflows will really help us make representations of this and use it in a different context.”

He concludes, “We are working with a bunch of firms looking at how to optimise their process end-to-end. And we are building technology for them, not in a one-off way, but we’re trying to get to a point where we feel like we have a value proposition we can offer them that solves some subset of their problems and then start working outward.”

Urban Splash has built a number of developments using modern prefab aesthetics

Urban Splash house factory

Factory_OS constructs modular units on a factory assembly line

Laing O’Rourke’s FreeFAB, a 3D-printed formwork technology

Conclusion

It only feels like yesterday when it seemed that BIM would finally revolutionise the building industry and deliver the efficiencies it so sorely lacks. I think the reality of BIM is that it is a stepping stone to the automation and industrialisation of mass-produced buildings. In a digitally fabricated world, the 1:1 fabrication model holds more value than a rough approximation.

The current generation of popular tools were all designed to enhance the nineteenth-century workflow of documents in federated processes. While this isn’t going to go away any time soon, there are certainly rumblings in the heartland. In a digitally fabricated new world, today’s BIM tools will need to be rewritten or replaced.

Digital fabrication and modularisation will bring lower cost, higher quality, more speedily delivered solutions. We could see a dramatic phase change in the industry within the next ten years.

That said, one wonders where all the talent and knowledge will come from. Possibly, we will see manufacturing engineers enter the industry.

While traditional design build is nothing new, and is frequently looked down on, I think it’s a matter of when, not if, this new segment sequesters a permanent percentage of the building market.

In the manufacturing space, aerospace led the way, streamlining its supply chains and defining process efficiency. Similarly, I think leading advocates of digital fabrication will come up with best practice. In manufacturing, the software vendors learnt from aerospace and codified these processes, for all to benefit. There will be design build firms that invest deeply and define their own processes to make them industry leaders. I suspect again the traditional CAD vendors will learn, codify and popularise best practice.

Until then, everything is going to be a little bit ‘Heath Robinson’, getting tools to drive systems with which they were never intended to work.

Learn more about digital fabrication in DEVELOP3D’s sister publication, AEC Magazine

Danjiang Bridge in Taiwan. Courtesy of Zaha Hadid Architects and MIR

Zaha Hadid Architects and Catia

Zaha Hadid Architects (ZHA) is renowned for using a plethora of design tools: Revit, Maya, Rhino, Grasshopper and so on. The toolsets used by each team is determined by the digital skillsets that team possesses.

The firm, meanwhile, is perhaps best known for being one of the early adopters of ‘Digital Project’, an architectural flavour of Catia V5 which Gehry Technologies created.

Digital Project was used to design the incredibly complex Guggenheim Museum Bilbao, because the software was able to handle huge, complex geometrical forms and send data to be directly manufactured from. In 2014, Trimble bought Gehry Technologies.

Catia persists in ZHA today although in the form of what Dassault Systèmes (DS) calls its latest version, the 3D Experience Platform (3DX).

At a ‘BeyondBIM’ event in London earlier this year, held by DS reseller Desktop Engineering, Cristiano Ceccato, associate director at ZHA gave an example of how modelling in precise detail enabled the architects to convince the construction firm for the Danjiang Bridge in Taiwan to trust the firm’s innovative design and enabled distributed collaboration based on a common platform in the construction process.

The topic of collaboration was key for Ceccato, and it’s not just about sharing models, he stressed but tracking changes, tracking issues and having all the information ‘unequivocally’ in the cloud.

Also at the event, Michael Sims, lead designer at ZHA, gave a demonstration of how teams use cloud-based 3DX in R&D to create a BIM Level 2 + workflow.

Given the complex geometry and detail of all ZHA buildings, the speed and power of Catia was self-evident. Sims admitted the learning curve was ‘a bit steep’ on leaving the file-based world. He also explained how ZHA works very early on with engineers and fabricators to establish the limits of the design shape and how Catia is that common language.

From talking with the ZHA speakers, there seems to be a feeling that the practice does want to standardise on a single platform with one version of the truth, which easily links to fabricators and engineers with collaborative components. The idea, they told us, is very compelling.