The 3D design giant, Autodesk, has had a history in simulation (for the purposes of design and manufacturing) for nearly a decade and a half.

Since it first acquired Solid Dynamics to put motion simulation inside Inventor back in 2005, the company has been through a long string of acquisitions to get it to this point. Solid Dynamics was followed by a pretty consistent streak:

- Moldflow for injection moulding

- PlassoTech for CAD integrated, basic linear structural work inside Inventor

- Algor for linear structural simulation

- Blue Ridge Numerics for Computation Fluid Dynamics

- Firehole for composites simulation

Last week, the company finally acknowledged that it had acquired NEi and its line of NASTRAN based tools.

This news first broke earlier in the year, but with the company now only looking to announce acquisitions once it has done something useful with the technology and organisation it acquires, it had remained pretty tight lipped. Now the cat is most definitely out of the proverbial bag.

NASTRAN was developed by NASA (the name stands for NASA STRucture ANalysis) in the late 1960s and early 70s. Its development has been interesting – mostly because of the business activities surrounding it – many of which resulted because of its origins at NASA.

While the NASA code has always been available to anyone that wants it, commercial exploitation of that code became inevitable.

It’s a solver code. That means that you have a set of tools that, given the right input data, will solve the simulation task and give you back the results.

What NASTRAN doesn’t do (on its own), is give you a graphical user interface to that process.

This is where the various commercial exploitations of the code come into play.

MSC.Software (MacNeal Schwendler as they were known back then) were first in the game and became the dominant vendor.

In 2002, the FTC investigated MSC and the judgement saw a cloned copy of its NASTRAN code handed over to UGS (who became Siemens PLM). That saw the market split into two camps – with MSC.NASTRAN and NX NASTRAN.

Alongside this, NEi has, for some time, been developing its own flavour of NASTRAN (which extends the non-linear capabilities of NASTRAN’s inhererent strength in linear simulation), offering solver level code as well as its own front-ends (with NEiWorks for SolidWorks being the most well know) as well as selling it alongside pre and post processing systems, such as FEMAP from Siemens PLM.

Its customer list is pretty fascinating. Not necessarily the large scale OEMs, but perhaps smaller tier one suppliers and smaller companies doing fascinating work, whether that’s in aerospace, automotive, auto-sport or marine design.

Due to its pedigree it’s one of the few solver codes that is implicitly trusted. I think it’s fair to say that it has become the de facto standard in the aerospace industry and widely used in most other industries where engineers are looking for robust, reliable code.

What are Autodesk’s plans?

The company has launched a couple of different new products and the approach that it has taken is telling. But first, what’s on the cards now?

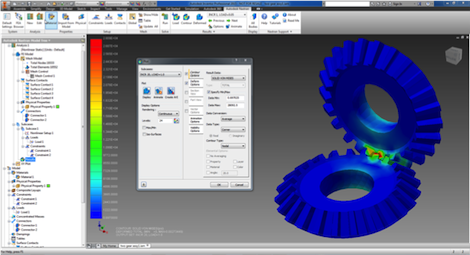

Autodesk NASTRAN 2015

Autodesk’s real time solver viewer – perfect for checking in on a solve or pulling data from those legacy studies

This is a solver level product that’s similar to the raw code that’s been available for some time from both MSC and Siemens PLM.

NEi took the base level code and extended its non-linear capabilities. For those that have already licensed NEi Nastran, this is what they’re most likely to be going after and using either their own home brewed pre and post processor or using a system like FEMAP.

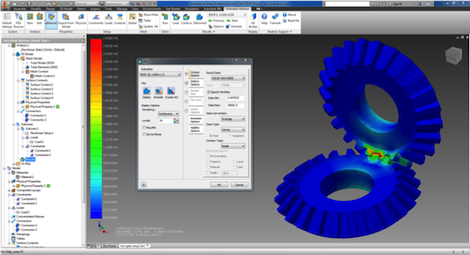

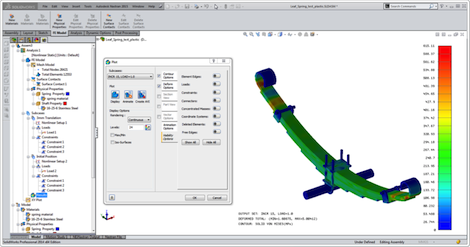

Autodesk Simulation 2015

For a while now, Autodesk has been reworking its simulation product offerings into a single interface (work that’s by no means complete) and the Autodesk Simulation product is the current state of the art.

It encompasses the Algor-based tools, CFD as well as some additional tools such as Autodesk Robot Structural Analysis for Civil engineering.

What’s changed with this is that users of these tools now have access to the NASTRAN solver alongside the existing methods.

The manner in which these have been implemented is also telling. While Autodesk has had its solver technology from the Algor acquisition for a while, it now offers the user a choice. They use the same study set-up tools, then choose whether to solve that simulation run using the existing, Algor based tools, or using the NASTRAN solver.

Simple as that – it’s a toggle.

Post processing is much the same, using common tools, no matter the solver used under the hood.

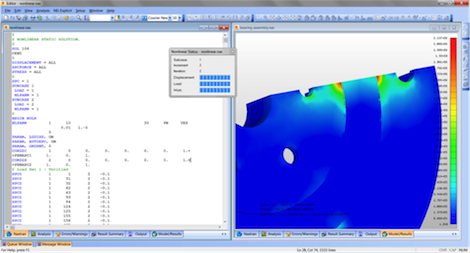

Autodesk NASTRAN IN-CAD 2015

Autodesk NASTRAN IN-CAD 2015 – all up inside SolidWorks

This is perhaps where Autodesk sees the biggest growth potential – by having CAD integrated tools that connect the design and engineering system to all the power inherent in NASTRAN.

The company is launching two products initially – both work inside Inventor and SolidWorks to provide the pre and post processing capabilities as well as the expected design cycle support (where design changes effected in the CAD system can be propagated into the simulation workflow and resolved).

The cloud?

It’s also worth exploring the cloud potential here. Autodesk has made the most strides upwards into the cloud of all the vendors and it has been delivering cloud-based computation services for some time now.

While unique, perhaps, in the design space, in the simulation world, this is pretty standard routine – Ansys, for instance, has been doing it for a while now.

With the Autodesk NASTRAN IN-CAD products (as well as the raw solver), users can elect to have their tasks computed using the cloud.

While for those with heavy horse power at the desktop, this might not be attractive, for those with either lower end compute power or perhaps peak demand issues or just huge iterative or multi-run (such as optimisation) problems, this could be very appealing.

Again, it’s pretty much a switch – the simplicity and cost in comparison to building your work cluster, getting licensing sorted and such, can’t be emphasised enough.

So what does it all mean?

The short message is that Autodesk got serious about simulation. While, with Algor, it had a compete set of tools that covered a wide spread of simulation requirements, just having the NASTRAN name gives the company so much more credibility.

FEA specialists are a highly specialised breed and they know which tools they like and which they don’t trust. NASTRAN’s pedigree at NASA got things off the ground quickly, but its use across a wide cross section of industry since has built that pedigree into something else. It has become a standard.

Why NEi and why NASTRAN?

The answer is probably down to a couple of things. Firstly, it’s one of the only other commercial NASTRAN codes out there.

If Autodesk wanted something, it was a pretty small pool of fish to dip their collective rods into. The other is that NEi’s work to extend the non-linear capabilities of an already robust linear solver code is just what many users are looking for – particularly those pushing the boundaries of engineering.

At the launch event, we got to talk to a long time NEi Nastran user working in the aerospace supply chain. They’ve standardised on NEi NASTRAN and the words were telling.

Firstly, it was clear that having simulation conducted on the solver gave the results an immediate level of trust amongst both its customers and regulatory bodies such as the FAA.

Yet alongside this, the gentleman raised an interesting point about the importance of non-linear analysis: Linear analysis indicates where a part or set of parts will fail as an absolute.

Where they shear, where they fracture. What non-linear analysis does is, as he put it, give you a ‘margin’ where deformation might be beyond limits of elasticity, but where your products don’t fail. It’s in that area where some organisations are pushing the boundaries of engineering and where they need something extra in terms of simulation.

When you consider that the team building Virgin Galactic’s space ships are a customer, you’ll realise exactly how far they’re pushing the limits.

Another factor is interoperability. If a company has a legacy of NASTRAN based studies, then having a system or capabilities inside Autodesk’s toolset, gives them interoperability.

If not the ability to reuse that data directly, certainly to interact with it. Its here that the NASTRAN Bulk Data file comes into its own.

This is the transport mechanism between the pre processor, the solver and the post processor. It’s commonly supported by many other vendors – that means that not only can other systems’ data be read, but also there’s greater potential for multi-physics, where multiple solvers work iteratively to solve advanced simulation tasks.

The future?

Autodesk is, already, looking beyond pure design integrated simulation and into some interesting areas.

One prediction might be that Autodesk will look to extend tools like iLogic (for parameter and logic based design automation) to encompass automation of both design and simulation.

That would take it squarely into the type of work that is typically the reserve of Dassault Systèmes and Siemens products.

This type of knowledge-based and template engineering approach would allow users to have an export set-up for common simulation tasks. Many organisations have complex simulation tasks that are essentially repeating variations of the same work.

Get the experts to build in their knowledge and best practice into a template, sign off the inputs and results and deliver that to the masses in the design office – leaving them free to work on the really difficult and out of the ordinary simulation work.

Autodesk has a good set of tools to start with. That much is clear. How the SolidWorks embedded users will react to this is anyone’s guess. But NASTRAN and NEi has a name that’s gained respect amongst a very specialist group of users.

Autodesk can capitalise on that and grow these tools’ adoption with a wider community and larger voice in the marketplace.

It should also see its name move into the upper echelons of the simulation world, alongside the likes of MSC and Siemens.

Autodesk is also doing some interesting things in the world of composites. We’ve already seen its acquisition of Firehole and its composites analysis technology – the addition of NASTRAN and NEi’s non-linear capabilities will mix into this rather nicely.

Autodesk spoke about how it’s looking to bring together this disparate set of technologies into a single environment and that’s going to be fascinating to watch over the next few years.

It’s a multi-physics world, so the differentiation between the solvers and processes used to simulate those different physics is counter intuitive – bringing them into a single environment makes massive sense to me. Gonna be fun, people!