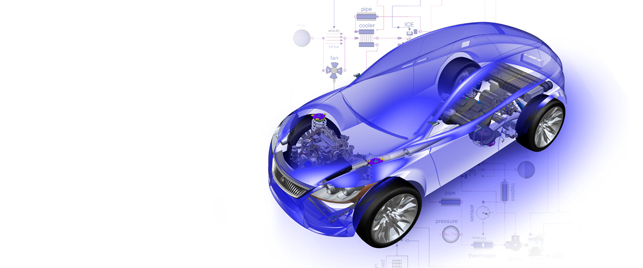

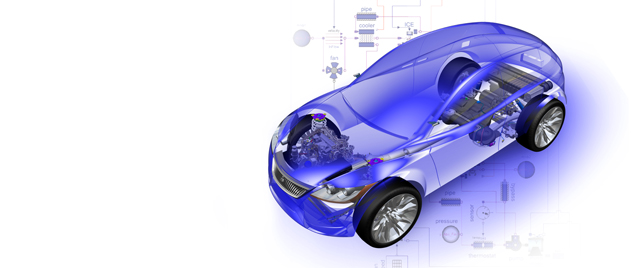

Systems engineering reflects the increasing challenges faced by modern engineering companies. Products, and the environments they are made in, are becoming increasingly complex.

Developers of complex electromechanical products such as cars need a unified and integrated approach to systems engineering. Dassault Systèmes is focusing on an integrated environment based on the Enovia V6 platform

In the past products were driven by their mechanical form and function. Today, while mechanical performance is still essential, software, electronics, harnessing and other elements of a product all play an equally, if not more, important role.

Cars are a perfect example. They contain huge amounts of software and electronics. At a recent presentation at the IBM Rational UK Innovate Conference, given by JLR (Jaguar Land Rover), group chief engineer Mark Stanton noted that software and electrics play a disproportionately larger part of the innovation content in their new products than ever before.

Even the most common cars these days contain millions of lines of code, and have upward of 50 ECUs (Electronic Control Units). These support a broad variety of functions including engine management, braking systems, cruise control, passenger comfort (climate control) and entertainments systems.

In addition to the products’ complexity, design, engineering and manufacturing, especially within larger companies often encompasses multi-company networks. Add to this fact that most (especially large) manufacturing companies have immense investments in existing software tools, personnel and infrastructure.

Companies may contain one or many acquisitions made over the span of many years; each with their own development practices, personnel and domain (e.g. electronic, software and mechanical engineering) hierarchies.

Chaos and complexity

Systems engineering can be viewed as the means by which companies are trying to create some ‘order from the chaos’.

As a party to this end the (systems) community at large has tried to capture the essence of the opportunity; producing ‘integrated management principles’ for complex projects.

The underlying principles of this cover product development from the abstract to the deliverable and beyond. Within this, integration and traceability are fundamental.

Systems engineering software

One thing is clear – the term “systems engineering” is getting a lot of airtime from the larger software suppliers in the market. Not least amongst Dassault Systèmes, IBM, PTC and Siemens PLM Software.

Some reading this article will question, why is IBM in the list? More will become apparent as this conversation progresses.

Within the essence of ‘what is systems engineering’ there are obviously many areas worthy of note. Bearing in mind there are hundreds, if not thousands, of technologies and companies who can claim support for ‘systems’, for the purposes of this article I’ll focus on a few brief observations which relate to the aforementioned vendors.

Systems engineering can be viewed as the means by which companies are trying to create some ‘order from chaos’

Within the PLM world, Dassault Systèmes, PTC, Siemens PLM Software and IBM have all made very significant moves to support customers looking to deliver improved systems engineering principles.

The first three have an area of (broad) commonality within their Product Lifecycle Management (PLM) systems: Enovia (Dassault), Windchill (PTC) and Teamcenter (Siemens).

PLM serves as one of the means by which to manage and maintain product information through the lifecycle. All three companies share a common mechanical heritage and their moves to support heterogeneous ‘systems’ has forced them to look beyond the mechanical to (amongst other areas) encompass software and electronic workflows.

Dassault Systèmes

Dassault Systèmes (DS) uniquely appears to be focusing on an integrated (primarily single vendor) environment based on the Enovia V6 platform.

The company acquired Dynasim in 2006; a firm that developed model-based design and simulation technologies, valuable in early through late stage development for designing, optimising and simulating complex systems at a model level.

The Dynasim technology is now available in an embedded CATIA module (CATIA Systems) as well as in its original standalone form. More recently (2010) DS acquired Geensoft, which provided tools for embedded software technology and Elsys (2011), a supplier of electrical schematic solutions.

In addition, Dassault’s acquisition of Virtools (2005) provided a convenient means with which to deliver visualisation for its model based technologies.

PTC

Surprising to some, but quite logical for a company wanting to deliver more to support the systems space, especially in the critical area of software engineering, PTC acquired MKS in 2011.

MKS was the developer of Integrity, a well-established platform for software systems lifecycle management, with significant strengths in area of embedded systems.

Prior acquisitions, which play to this domain also include Ohio Automation (2004) for ECAD collaboration and those covering areas such as quality, metrics and environmental performance with the acquisitions of Netregulus (2007), Reflex Software (2009) and Planet Metrics (2010).

Siemens PLM

Siemens PLM Software has planted its stake in the systems domain through its Teamcenter software suite, which has evolved significantly over the recent past to cater for the needs of (amongst others), electronic and software disciplines.

Focusing on an expansion of its technologies from its traditional mechanical strengths to those of software and electronics, Siemens has put much effort into integrating with third parties.

Examples of these are in domains such as model based technologies, for example Maplesim (Maplesoft) and Matlab and Simulink (MathWorks), and not forgetting Enterprise Architect (Sparx) for real time software systems development.

In a recent meeting with Siemens management it was clear that the systems space is a principal focus in the short term with acquisition a likely option.

IBM

The last but by no means least in this list of noted companies is IBM.

As the largest player in the IT and more pertinent, (embedded) software engineering space, IBM’s acquisitions of Rational Software (2003) and Telelogic (2008) provide it with unique competence and credibility in systems.

IBM is markedly pragmatic on customer needs; notably that the real world of systems is about delivering value in a heterogeneous world. It sees significant customer value in enabling open integration and providing a platform that inferences information no matter when it was created, wherever it may be, and however it was created.

With proven experience in software technologies such as requirements and asset management, testability, quality, service and complex data assimilation (for example Watson) and with its enormous systems integration arm, IBM is set to take a much greater role in the broader systems space; not forgetting, of course, its initiatives to promote open integration with OSLC (Open Services for Lifecycle Collaboration).

Conclusion

Not surprisingly, with the escalating complexity of the goods we make, and bearing in mind the increasing value of software and electronics within these, companies must consider reappraising the development products and processes we use to deliver product to market.

As an approach to managing this complexity, systems engineering has elevated itself to the top of many corporate agendas.

I’d suggest that over the short to medium term this trend will move to encompass a broader variety of companies from many different market segments (including, for example, industrial machinery); and not just large ones.

Allan Behrens takes a look at the benefits of a Systems Engineering approach

Default