Martyn Day: It must be one of those life changing experiences to bail out of a company the size of EDS, start up the privately-financed UGS, and be out on your own?

John Clendening: In 2004 it was very exciting, and we joked that we’d got a billion dollar company to start up and get off the ground – it felt very entrepreneurial and the business remains so. It felt like we were getting an entirely new company off the ground, from a branding perspective.

We had a billion dollar revenue stream under our belts and a long history of very strong customer relationships, so we had the wind at our backs to start with. Our responsibility as a business is to drive profitable growth and keep our shareholders and/or superiors happy, and in spite of all of the changes we’ve experienced, we’ve had 20 consecutive quarters of year-on-year revenue growth. That started when we were part of EDS, continued through the UGS days, and now into Siemens. The Siemens acquisition closed in May 2007, and under Siemens we’ve had four full growth quarters: we’re aiming towards five at the end of September. The first full quarters as part of Siemens have continued our string of success, so it’s been great so far.

We have a very intense customer focus and it drives everything we do – a lot of people say that, but we back it up with numbers. Our top 100 customers have been with us for an average of 18 years

MD: So what’s been the driving force behind that growth?

JC: First I’d say we have a very intense customer focus and it drives everything we do – a lot of people say that, but we back it up with numbers. Our top 100 customers have been with us for an average of 18 years, and we’ve got a customer maintenance renewal higher than average in the software industry. The overall software industry is 82 per cent, the PLM industry is at 92 per cent and we’re at 96 per cent. Our focus is all about the customer and what we do for them, and we didn’t lose that in the transition. We stayed focused on what we do best. Siemens didn’t change that and they didn’t force us to get overly caught up in integration activities to the extent we would lessen the intensity of this focus.

One of the things that really helped was that we did not integrate our sales force with Siemens sales – ours was kept whole and independent. This doesn’t mean we don’t leverage opportunities in the market when we have them with Siemens, like the big VW win we announced a few months ago – but for the most part, it was business as usual and it’s all about customer relationships.

That was a lesson that we learned from our EDS relationship because the integration there did not have clear delineation of responsibility for joint accounts between EDS and UGS – I think that had a negative effect on us. We all learned that lesson and we’ve all benefited from it.

“Would we have launched [sync tech] as quickly and effectively as we did without Siemens? I think the answer is no”

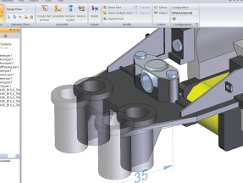

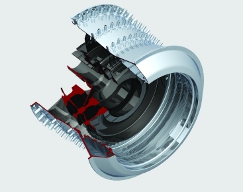

MD: Your renewed efforts in marketing have been most visible with the recent launch of Synchronous Technology in Solid Edge and NX.

JC: We really wanted to make a statement to the market, and one of the reasons we put so much effort and pizzazz behind it was that we were so fundamentally excited about the technology because we knew it was breakthrough technology in the CAD space: it was incumbent on us to make sure the market really understood.

Siemens really accelerated the synchronous technology launch to market. They saw the technology in due diligence when they were looking at buying us, and they got so excited about it that they were able to put R&D money in, so they accelerated the technology to the point where we could start testing it in actual products. Would we have launched this technology as UGS? I suspect the answer is yes. Would we have launched it as quickly and effectively as we did without Siemens? I think the answer is no. It was a really important aspect of the launch, because it was our first opportunity since the acquisition closed to come to market with something very specific and say, “This is a perfect example of bringing together Siemens and UGS.”

MD: What’s the integration story between the two companies, Siemens and UGS?

JC: We had about 100 people involved in the integration, working full time or part time, pulling together different processes for every administrative function you could think of: HR, marketing, sales. The whole deal. That was very intensive, but the feet on the street, the sales people, they were kept out of that 95 per cent of the time because we wanted them to focus on the customer in the market. I am an example of the people who were almost full time for three to six months, starting with the acquisition announcement to post-close. Integration is now complete.

We have a project called Archimedes, which is something that has come out of the integration that’s driving towards new software. It is essentially the idea to create a cross-Siemens industry sector software initiative, to design and develop new software solutions that unify with Siemens focus on production. We’re working numerous use cases on how this will provide the basis for the new solutions. We haven’t set a date for launch but we’re working with the two other Siemens business lines [Siemens Automation Systems and Siemens Motion Control Systems], doing joint R&D to come up with these new software and product solutions.

We are calling one of the developments Adaptive Manufacturing. With Teamcenter, we’re working on intelligent production components with the integration of process design with automation design. Another is Virtual Commissioning, which is essentially the validation engine for process automation and MES.

“We wanted to show that Siemens saw CAD (including Solid Edge) as being a fundamental part of the business they were investing in

MD: Looking at the Siemens product ranges, the two areas that don’t fit in are Parasolid and Solid Edge . Does Siemens understand why UGS had these products?

JC: It’s interesting that you bring this up. We heard from the very beginning from analysts and journalists that they weren’t sure if Siemens was going to be committed to the CAD market. We think that the reason this perception was created was because it’s almost a semantics issue. Siemens often uses the term ‘digital factory’, which we think of as Tecnomatix, but Siemens uses that term for all of PLM.

On the Solid Edge thing, one reason we put so much effort behind synchronous technology and were so excited about it was we believed it’s a breakthrough technology. Another was that we wanted to make a statement about how Siemens accelerated it to market and the third was we wanted to show that Siemens saw CAD (including Solid Edge) as being a fundamental part of the business they were investing in. Parasolid is a core part of our business. If you look at all the competitive products that use it, one thing that will never change with us is focus on open platforms and open systems, and Parasolid is one way that we exemplify that in the market. Siemens is adamant about openness; all of its technology is produced in the same way.

“We’re working on intelligent production components with the integration of process design with automation design”

MD: We are in turbulent economic times. What’s the outlook for PLM given the financial situation?

JC: I could talk to you about that all day. It’s fascinating, and I’m also saying that as a consumer. Two things come to mind. Number one, over time as the PLM toolkit has expanded, it is increasingly being looked at as mission-critical technology. If you need to get products out, this technology is front and centre to doing that, so that’s a very positive thing for PLM. I think it’s good for the industry.

The other trend I would point to as a positive for continuing PLM investment is innovation. Although everybody uses that word, the thing we always talk to our customers about is that PLM is again the only real enterprise app focused on top line growth, especially now that it’s expanded to that enterprise level application. The others are focused on bottom line growth, such as controlling and maintaining costs, and there’s nothing wrong with that: you have to get product out the door as efficiently and quickly as you can in order to drive the top line growth that the market is always going to expect from a leader.

MD: So companies are compelled to invest in PLM technology, even in economic down times?

JC: I think that leading companies always want and need to get the best products out as quickly and as efficiently as they can, which is top in the minds of people looking for good value. Good value is more important to consumers now more than ever before. Value is where PLM comes in, and at the end of the day that’s what we provide to a company: the opportunity to get something through the process, from idea to market, to get through that innovation curve internally faster than they can do without us. Then to get the product out the door and into the hands of the customer as fast as possible. I don’t see the value in that equation ever going away.

www.plm.automation.siemens.com

Martyn Day talks to John Clendening, senior vice president of marketing communications for Siemens PLM