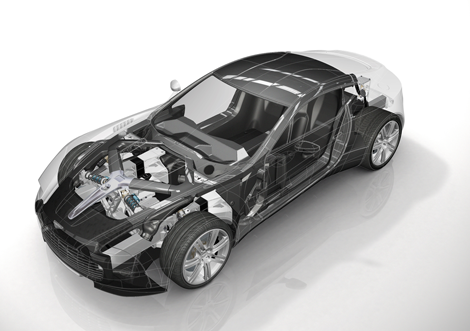

For those working in automotive design and manufacturing, there’s further big news (after Daimler’s switch to NX last month) this month. Aston Martin has announced that it’s standardizing its global sports car development process using Siemens PLM’s NX software for “integrated computer-aided design, manufacturing and engineering analysis (CAD/CAM/CAE)” and Teamcenter software to manage its “product and process knowledge.”

According to the press release, Aston Martin “began its extensive and ongoing competitive PLM technology evaluation two years ago. The decision to migrate from its current technology to NX and Teamcenter is critical to its mission of continuing to produce some of the world’s greatest sports cars.” Just as a point of reference, Aston has been a strong i-deas user for some time, presumably from its days as part of Ford’s Premier Automotive Group (along with Jaguar and Land Rover), between 1995 and 2007.

Siemens were understandably bullish about the news, with the press release containing the following comment “Aston Martin’s decision to adopt Siemens PLM Software’s technology as the corporate-wide PLM standard highlights the importance of an open PLM environment to enhance innovation and manage increased sophistication. It also demonstrates the scalability of Siemens PLM Software solutions to match the diverse deployment requirements of the full spectrum of automotive OEMs.” That said, there’s no commentary from Aston Martin executives to back up that statement, rather just an analyst and a Siemens PLM executive.

NB: Just as a note, this shouldn’t be confused with Aston Martin Racing, who recently announced a shift to Pro/Engineer and Windchill PDMLink from Siemens PLM NX after it’s technical partnership (read: sponsorship in exchange for low-cost software) expired.

Hyundai moves to Windchill

Just a wee bit earlier than Siemens announcement this week, PTC also had news of it’s own. Hyundai Motor Company (and it’s associated brand, Kia) has adopted Windchill as its PLM backbone. Hyundai, once the butt of many car fan’s jokes, is now the fifth largest automobile manufacturer (by market share) and the fastest growing.

Hyundai’s Curb is a compact Urban Activity Vehicle (UAV), designed by it’s Design Centre in California and if it makes it into production, it’ll be manufactured in the company’s colossal facilities in Korea

Again, the benchmark period seems to be a two-year and Hyundai eventually chose Windchill as the core platform as it goes through a consolidation process to bring multiple systems into a single environment for managing product data and “related processes for vehicle development.” Initially this will take place in its core R&D groups but the intention is to extend use of the solution through its “internal and external value chain.”

According to the release (which for once, has some interesting details), the first phase of delivery (already underway) establishes a system of record for the complete vehicle [the engineering Bill of Materials] and for Change Management. Phase I will also include management of Catia data and a Digital Mock-Up (DMU) environment.

There’s even a quote from Dr. H. S. Lee, vice chairman of HKMC’s R&D centre, who said “In order to support our ambitious growth plans, we have prioritized the need for a faster and more efficient environment to facilitate global concurrent product development and support the rapidly changing requirements for our vehicle programs. Two years ago we began looking at all available PLM solutions to meet our requirements. We selected and procured with PTC because of Windchill’s impressive results in our comprehensive benchmarking process, PTC’s proven track record as an effective partner in powertrain development, and its growing strength in the automotive industry.”

Few thoughts

For me, this is another in a long string of interesting moves in the automotive world. While the news from Daimler was more of a shock, the Siemens x Aston Martin news is bound to be another kick in the teeth for the team at Dassault Systèmes. Catia is widely used in the automotive world for Body in White engineering and this sees another OEM move away from Catia to Siemens’ alternative. Why would they do that?

I’m not entirely sure and you can bet your pay check you won’t get a comment from Aston any time soon. One thing that does occur to me is that it’s been 4 years since they split away from Ford. While its stock in trade has always been the DB and Vantage series of sports-cars, the company is also seeing a move into smaller vehicles such the the Cygnet small city car (due for launch this year). There are also the challenges of an inevitable shift away from fossil fuel based vehicles. That shift in reliance on platform sharing perhaps timed with a shift in power-train basics, means that many automotive OEMs are in a perfect position to reevaluate their toolset of choice for the next decade.

Aston Martin’s Cygnet is a break from the company’s traditional high performance vehicles into high luxury city vehicles

There’s also an interesting trend in the two year benchmark cycle. Automotive OEMs have been behind the drive for a PLM-based solution – they’re the perfect fit for a PLM implementation. Large variance in their highly complex products, outsourcing heavy supply chain, common platform and sub-system sharing across not only vehicles, but brands. Take Hyundai and Kia,they share many common components and systems between them. All of this operating across geographic boundaries, timezones and languages. So why now?

The auto world has been an early adopter of technology and in the case of PLM it looks like many have reached the limits of their initial implementation and are looking to progress things further, but that doesn’t necessarily mean working with the same vendor. Product Lifecycle Management evolved from Product Data Management. PDM was always about predominantly managing CAD data. As a result, it made perfect sense to take your PDM from your CAD vendor. PLM is a different beast. And it looks like the single sourcing CAD+PLM isn’t working anymore.

Many OEMs appear to be looking at their toolset and choosing the systems that fit best to their workflows, process and requirements – and that doesn’t always mean the same vendor. Hyundai/Kia is the perfect example. They’re using Catia as their core design tool, but it looks like they’re running with Windchill as their PLM backbone. Ford are doing the same, but choosing Catia and Teamcenter. Yes, some are still single sourcing, such as Daimler (with NX and Teamcenter) but there’s an intriguing shift.

There’s also another thought. There have been three pretty big moves away from Dassault or a decision to not take on Enovia during benchmarks. With a two year benchmark cycle being common, one has to wonder if there’s a link back to the launch of V6? A curious thing indeed.