PTC is one of the key founders of desktop parametric, associative feature-based, solid modelling. With Pro/Engineer, the company decimated the once high-end UNIX-based CAD market, placing powerful tools on the desktops of many thousands of engineers worldwide.

Jim Heppelmann has been PTC CEO since October 2010 and will be leading the introduction of Creo

PTC combined a robust product with a very focussed sales organisation, taking the company to over a billion dollars in revenue and it was added to the S&P 500 stock index in 1997.

Unfortunately the company was slow to move to Windows and received a mauling from the cheaper SolidWorks (launched 1995) and other young upstarts, which took PTC a number of years to recover from. Its resurgence was cemented with the release of the Wildfire version of Pro/Engineer in 2002.

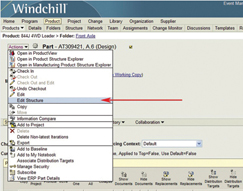

In 1998 the company acquired a ‘PLM’ (Product Lifecycle Management) system called Windchill, which was headed up by the now CEO, Jim Heppelmann. This business unit grew to provide a significant amount of revenue for the company, firmly placing Heppelmann as the key technology vice president, next to C. Richard Harrison, the highly sales-oriented previous CEO of the company.

Last year Harrison stepped down and Heppelmann took over the reins. Within a matter of months PTC announced Project Lightning, which turned into the new ‘Creo‘ platform and represents a major refresh of its modelling products, blending Pro/Engineer with the acquired CoCreate direct modelling capabilities, together with a new User Interface. Creo’s claim is that it can work intelligently with any geometry.

While Creo’s promises are big, there has been some confusion in the transition, given the long history of the previous generation of products. DEVELOP3D managed to get a little of Jim Heppelmann’s time to discus Pro/Engineer, Creo, Wildfire and the general state of the CAD market.

Branding

Diving straight into the rebrand of Pro/Engineer, I had to express our shock, and that of some of PTC’s customers, at the loss of such an iconic brand name. Heppelmann replied, “Well, I think Pro/Engineer obviously has terrific brand equity. But I think Creo is trying to accomplish some things that are different to what the Pro/Engineer brand has stood for historically. The Pro/Engineer brand in some ways is limiting.

[Creo] says you can have some users using 2D, some using 3D direct, some using 3D parametric. And for the first time ever, you can live in harmony and work productively together

“The Creo story is quite different; it’s new and exciting and if we just called it some new capability in Pro/Engineer I think it would get discounted versus what it’s really all about. Customers know that for us to change the brand, we must be up to something significant and I think they get a certain degree of comfort that PTC has a strong CAD message out there again. There’s actually quite a bit of conversation and activity happening right now and quite frankly it’s driving a pretty nice uptake in our business – our CAD business specifically.”

Looking at the manufacturing industry, it is true to say that despite the doom and gloom, the art of designing and making things is the only market segment growing. I asked Heppelmann what was driving his business.

“I think there are a couple of phenomena that are happening simultaneously,” he replied. “One is the economy simply getting better. We’re also starting to do a lot more cross selling of the traditional CoCreate product, now branded as Creo Elements/Direct, into the Pro/Engineer base and vice versa because we now have a story that actually makes those two complementary and gives them both some future destination when these live in harmony. So I think it’s this combination of a better economy, a lot of excitement and discussion and confidence, and then the ability to cross sell products we’ve had for a while, but really didn’t try and sell.”

Creo and direct modelling

While direct modelling technology has been around a long time, championed by CoCreate prior to PTC’s acquisition of the company in 2007, it seems that the major vendors – Autodesk, Siemens PLM, Dassault Systèmes and SpaceClaim – are all pushing similar capabilities. I asked Heppelmann if having direct modelling was really that important for customers.

Heppelmann explained, “Well I think it really comes back to ease of use. I think the easiest CAD technology to use is 2D. Because it’s not that much different to when you are four years old writing on the wall with a crayon. The next step up from 2D is 3D direct modelling. You know, it’s 3D, but it doesn’t bring in the sophistication and complexity of parametric features. And then, of course, parametric features are the most sophisticated, and the most powerful.

“What’s interesting is that while 3D parametric modelling has become a big business, 2D and direct modelling never went away. This is because, for certain users, in certain situations, 2D is the best answer. And I think for certain situations, for certain users, 3D direct is the best answer.

And then for many people, 3D parametric is the best. But in the past, because these things were incompatible and couldn’t be mixed together in a meaningful way, companies were forced to standardise on either 2D or 3D direct, or 3D parametric. Creo is the first product that blends them together, and says you can have some users using 2D, some using 3D direct, some using 3D parametric. And for the first time ever, you can live in harmony and work productively together.”

By adding the company’s engineering management solution, Windchill into the mix, I wondered if Creo is about the integration of all of PTC’s technologies.

“Absolutely,” replied Heppelmann. “Sometimes we refer to it as enterprise CAD by which we mean that while there’s a story for the power users in engineering, there’s a story for some of the people who are upstream and downstream from them, people who want 3D, but don’t need that power and complexity and cost. There’s even a story for the people who are further upstream, and even further downstream, who want 2D, either for ideation on the front end, or just for simple documentation on the back end.

“The key story for the manager is how data flows from 2D ideation, to 3D ideation, to 3D engineering – then over to simulation, manufacturing, technical publication and then downstream to documentation. And this intellectual property asset is getting re-used and re-leveraged and value added to it, and harvested in other areas.

“This is the first time anybody’s ever had a product that could appeal to so many people who have different requirements, but actually keeps the data flow going.”

Heppelmann at the launch of Creo in October 2010

Product Lifecycle Management (PLM)

In the interview with the CEO of Autodesk, Carl Bass, in February 2011, he was very complimentary towards Windchill out of all of the PLM products on the market. Bass could see that the product was getting traction and had some velocity in the market. This, despite saying some harsh words about the PLM market over the years. I put Bass’s neo-fan status to Heppelmann and asked what was changing in the PLM space.

“I think Carl Bass is generally warming up to the idea of PLM and probably seeing them add some strategic value he might have missed the first time around,” replied an amused Heppelmann. “Dassault has forced this issue a little bit, with a sort of forced bundling in V6 of Catia and Enovia – and you know I think Catia’s a pretty good CAD system.

“I think Enovia is always behind in PLM. When you force bundle them, then you present customers with a hard decision. And I think, for example at Daimler they decided ‘if we’re going to have to switch PLM systems, another alternative would be to switch CAD systems and quite frankly, that might be a better alternative.'” [Daimler recently moved from Catia to Siemens NX so it would be more tightly integrated with its Teamcenter-based Smaragd data management system].

The cloud

While Autodesk and Dassault Systèmes appear to be running headlong into developing cloud-based applications, my recent conversations with PTC representatives indicated that, as customers were not asking for it and the benefits were not clear, PTC was not heading to the cloud anytime soon. Given the error in underestimating the move to Windows, I asked Heppelmann for his view of CAD on the cloud.

“With Project Lightning we stepped back and we asked ourselves: given that the CAD business is 25 years’ old, what are the big unsolved problems?” he stated. “And we came up with a list of problems.

“First was ease of use, which we think was fundamentally unsolved. It still takes a week to learn a modern CAD tool. People don’t have tolerance to spend a week any more, learning something. We also think in the CAD industry, interoperability is a big problem and this idea of more sophisticated real-world assembly modelling or product configuration modelling is a real problem. Yet in the CAD world we have to manually put these assemblies together and you can’t really model the real-world product anymore because there’s just too much manual effort in all this configuration.

“So, we identified these key problems and then if I say, well which of those problems does the cloud solve? It doesn’t actually solve any of those problems! It solves some other problems – perhaps ease of installation, perhaps cost of ownership, things like that. But I’m not sure those are the key problems. So we’re not pro-cloud or anti-cloud, we’re just trying to solve what we see as the biggest problems, and we don’t see solutions to these biggest problems being in any magical way enabled by cloud technology.”

While the company does have a version of Windchill in the cloud for PLM-on-demand (partnered with IBM) I wondered if PTC was actively developing and trialling any other cloud-based technologies.

“Our model is, take that one big chunk of code, break it into many smaller chunks, that are more like the kind of thing you’d download on your iPhone,” explained Heppelmann. ” So, small apps, and make some of these apps available for a free download. I think you’ll see us do that. Now, at that point though, it’s not a cloud. You’re getting the app from the cloud, you can disconnect from the network and keep using it. The downloads are small and tight and the products are simple and sort of CAD-focused. So maybe a 2D sketching tool is a 2D sketching tool, it’s not a full-blown 3D parametric CAD system that’s 300MB of data to download.”

Talking about Apps and ‘the cloud’, it made sense to discuss the rise of tablet computing and if it had a role in PTC’s vision for future product releases. Heppelmann appeared cautiously positive.

“I think the world really wants a better tablet. While the iPad is extremely interesting, it maybe still has some shortcomings. It doesn’t run Office and I’ve noticed that people who carry an iPad still carry a laptop, by and large. But I think the idea of a mobile lightweight connected device that has a screen big enough to be used for graphics design is very attractive for content. I’d certainly like to see our Creo apps on those types of platforms including the iPad, on a go forward basis but I really don’t want to commit to that.”

Windchill

Having been the father of Windchill, it’s difficult to not hear the enthusiasm when Heppelmann talks about the product. However, as a CEO, this enthusiasm is equally borne out when you hear how much it contributes to the company’s bottom line.

“Windchill is doing exceptionally well and just to put it into perspective – I think we all look at SolidWorks as a great business for Dassault Systèmes and Windchill’s substantially more successful than SolidWorks. While SolidWorks was launched in 1996, and I think it’s a $350 million dollar business right now, Windchill was launched in 1998 and it’s going to be a more than $500 million business this year. So Windchill is 1.5 times more successful than SolidWorks from that perspective.

“Our plan for this year is about $1.1billion, maybe a little more than that, and, this year for the first time, we anticipate that Windchill will be half, or more, of that total revenue. So, to some extent we really have become the ‘Windchill PLM’ company because that’s become as big now as everything else combined. If you look back all the way to 2004, we’ve had a 17% average growth rate, compound annual growth rate, in our Windchill business.

If you back up to before the bad economy it would be in the low 20s. But even with the year of bad economy in those numbers we have a 17% growth rate – which is, you know, amongst the most successful software products in any software industry right now.”

Arbortext

Based on my ‘Last Word’ comment in the February edition of DEVELOP3D about the lack of decent 3D instructions and documentation, I’m quite interested in that area. PTC has a fairly unique solution called Arbortext, which it acquired back in 2005. The software enables the automation, assembly and publishing of product information, marketing documents, service instructions, maintenance procedures, technical publications, legal information and software documentation. I asked what was happening with Arbortext adoption.

“It’s a very interesting story with Arbortext, we are moving away from a focus on documentation, to a new focus on service information,” replied Heppelmann. “In the past, Arbortext was a way to efficiently produce large volumes of technical documentation and what we’ve found since is that companies see technical documentation as a necessary evil. They have to produce it, but quite frankly the customers of that documentation don’t really like documentation, don’t necessarily want more documentation. The whole system has somehow broken a little bit.

“We came up with this analogy of the difference between maps in a car and a moving map navigation system. Five years ago, if you’re driving across the country, you would have maps in your car and you would have needed a lot of maps, because each city or state, or section of a country needs a different map.

And then roads change and maps become outdated. If you look at a GPS-based navigation system in your car, it already knows where you are and the route actually has surprising little information, it might be, just ten turns to get to your destination. However, it’s very good at coaching you through this process, as opposed to giving you all the information and telling you it’s in there somewhere.

“We want to do the same thing for technical documentation, move it to an expert delivery engine. The key thing about that is, now we can start delivering 3D data. Because we’re actually saying ‘don’t print it.’ This all breaks down when you work backwards from paper, that’s why it’s hard to use 3D data.

“In the new world, deliver it to your iPad or your laptop, or what you have, and just get rid of this crazy system of moving all this rich information through dumb paper to the end user, which destroys the ability to use the 3D data in the process. I think people are taking a whole new look at it, because we’re now positioning Arbortext not as a better way to create documentation but as a better way to run a service process.”

Consolidation

Acquisitions are always happening within the industry and, as I write this, Autodesk has just announced the purchase of CFD expert, Blue Ridge Numerics. In recent years PTC has grown considerably by acquisition, the last major deal being CoCreate. I’d asked Autodesk’s CEO, Carl Bass the same question on consolidation in our market back in December of 2010, and he thought CAM was next. I was interested in Heppelmann’s view on the market. He disagreed with Bass.

I think Pro/Engineer obviously has terrific brand equity. But I think Creo is trying to accomplish some things that are different to what the Pro/Engineer brand has stood for historically. The Pro/Engineer brand in some ways is limiting

“I think some things are consolidating and some things are probably moving in the opposite direction; specialising. I actually don’t know if CAM is consolidating. I think there are more independent CAM vendors now than there were ten years ago and I think that’s because within CAM there are so many specialities that the products are becoming very sophisticated. If you bought one of the leading independent CAM products, they work with any CAD technology. The integration between CAM and CAD, even from different vendors, is good enough that it eats into the value proposition of buying it all from one vendor.

“Normally if you buy it all from one vendor, you might lose a certain degree of specialisation, but you would pick-up a certain benefit of integration. But I think right now people are saying the integration’s good enough. I need the specialisation. I’m not sure CAM is consolidating, I think it’s actually moving in the opposite direction.

“At the PLM level, there are a lot of applications adjacent to PLM that arguably could be part of PLM – a good example is requirements management. Companies say: ‘Do we really need a separate database in the data centre for requirements? Couldn’t we just put the requirements in the PLM database and get rid of one system and then we get better traceability, better configuration and change management?’ There are lots of good reasons why requirements management, as a simple example, should be consolidated in the PLM.

“Should there be better consolidation of MCAD, E-CAD in software engineering tools? Probably, because a lot of people are developing mechatronic products that have all these elements and today the tools are all quite sophisticated, but they don’t work together well. I think it’s actually a pendulum that swings back and forth and some things around the PLM backbone are consolidating and some things like CAE are not.”

“PLM is becoming very important and I think it’s starting to have more impact on CAD decisions. And here, I think PTC is winning the PLM battle, so the connection between PLM and Creo is very important. The ability to do next generation assembly modelling, for example or the ability to manage to connectivity between 2D, 3D direct, 3D parametric data, across multiple users and departments. PLM’s becoming important at the CAD decision and important even separate from the CAD decision, and we’re becoming the leader there. I think it becomes very reinforcing of our CAD strategy and I wouldn’t trade places with any vendor in the industry right now.”

www.ptc.com

Martyn Day in conversation with PTC’s CEO